Chemical Conversion

General Information

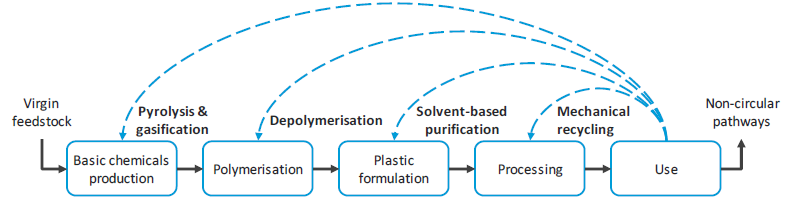

Chemical conversion or chemical recycling is a diverse sector that encompasses dozens of technologies that utilise chemical process to purify or break down plastic waste into polymers, monomers, oligomers or hydrocarbon fuels.

The sector is characterised by its ability to process a wide range of plastic waste, addressing overlooked plastics that do not have end-of-use recovery solutions. This is achieved through a range of technologies, including:

-

Purification technologies, which process single-stream or mixed plastic waste by separating and extracting unwanted chemicals (e.g. colour, additives) from the target polymer by using solvents.

-

Depolymerization technologies, which process single-stream plastic waste, and chemically alter the structure of the polymer by breaking bonds in the main polymer chain (primarily applicable to PET, but not to PE and PP). Depolymerization has potential to be used for pre-consumer textile recycling, providing a clean stream of polyester with known polyester purity level.

-

Conversion technologies usually refer to pyrolysis and gasification technologies. Both types of technologies differentiate themselves from other technology categories by being able to process mixed plastics or mixed solid waste with plastics to produce hydrocarbon products like naphtha and methanol.

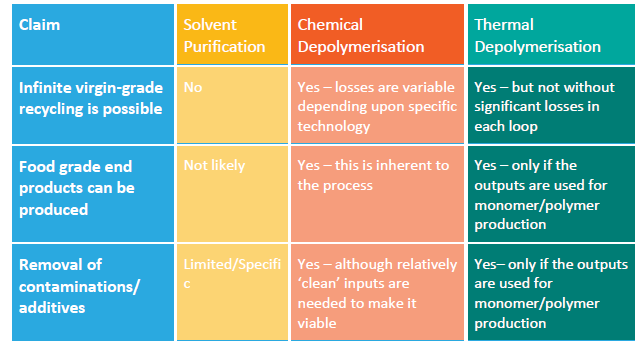

Chemical conversion technologies differ from mechanical recycling by their ability to remove chemical additives and colour from plastic waste, producing like-new plastic polymers that can go into high-value cosmetic or food-grade applications.

The chemical conversion sector is at varying stages of market readiness, with purification and depolymerization technologies in the early stages of commercialization (in the US and Europe), while conversion technologies are the most mature. This new and growing market currently has very low penetration in EMDEs but in the future can play a bigger role in those regions. If developed with the right principles, chemical recycling can play a key complementary role to mechanical recycling. Commitment to principles for good chemical recycling is crucial.

To scale effectively, chemical conversion (and mechanical recycling) relies on three key elements: feedstock security, offtake security, and a supportive regulatory environment. Feedstock security involves design for recycling and scale-up in collection and sortation, including advancements in sortation technology. Offtake security can be ensured through offtake agreements. The regulatory framework needs to be ambitious, supportive of a complementary system that aligns with the principles of good chemical recycling, and provide clarity.

Key claims for chemical recycling technologies

Source: Hann S., Connock, T., "Chemical Recycling: State of Play," Eunomia (2020)

Two main concerns have been raised regarding the potential negative impact of chemical recycling on human health: first, the emissions and discharge from chemical recycling processes contain hazardous chemicals; and second, substances of concern from feedstock waste can be reintroduced into output recyclates. Further research on both issues is needed.

Costs and revenue model

Chemical conversion technology companies need to be well capitalized as they navigate from pilot stage to commercialization stage, because piloting feedstock and outputs is lengthy and capital intensive. Capex requirements are lowest for depolymerization technologies -- some examples from Europe suggest average cost of ~EUR 6.5 million kt. The absolute capex amounts for conversion technologies tend to be higher as their more mature technologies require relatively bigger facilities. Conversion technologies typically have lower operating costs due to their ability to accept mixed-stream waste.

Revenue streams vary depending on the technology, with purification technologies generating revenue from the sale of high-quality recycled plastic and depolymerization technologies earning revenue from the sale of monomers, both of which can be used for high-value application outputs such as food packaging. Conversion technologies generally produce lower-value outputs, such as methanol, but in some regions can benefit from tax credits and subsidies for renewable fuels. Technologies which can accept mixed and contaminated materials can also receive tipping fees for avoided landfill costs.

Investment Readiness Assessment

The investment readiness assessment uses a scoring system across three key parameters to provide a comprehensive view of the investment viability of the finance demand opportunities. Scores vary from 1 to 5. Investors and stakeholders can use this scoring system to make informed decisions and prioritize investment options based on their specific objectives and risk tolerance.

-

Investment Scale

3Chemical conversion is a capex-intensive sector, with conversion technologies being mature enough to require large scale commercial plants. The size of installations matters and is expected to grow with technology readiness level and market maturity. Chemical conversion may also require investment in waste collection and materials recovery facilities upgrades to improve the quality of the feedstock.

-

Return Potential

3A few large-scale commercial plants in Europe and North America have demonstrated possibility to generate attractive return on investment. However, limited scale due to early-stage technology or unavailability of reliable feedstock can result in high capital cost per unit as well as fixed costs.

Return can be improved by focusing on high value applications output such as food grade polymers, and through developing operational efficiencies as the technology continues maturing.

-

Perceived Risk

4While significant investment commitment has been made in Europe, the US and Japan in chemical recycling technologies, a large share of these technologies is currently at pilot or demonstration scale. Very few industrial scale plants are in operation nowadays and scaling-up these early technologies is a long process with significant development and implementation risks associated.

In addition, chemical conversion output quality, quantity, and process efficiency often depends on feedstock consistency and thus on existing waste management infrastructure. While chemical conversion can address low value plastics which are often overlooked by mechanical recycling, the recovery rate is much lower in low to middle income countries, and is often contaminated. Additional logistic and processing costs can add significant operational and capital costs. Chemical conversion operations are likely to require a higher level of expertise than traditional mechanical operations, increasing the overall implementation risk.

Finally, chemical conversion is a highly controversial technology which many NGOs and scientists advocate should not be used because of its high energy intensity, CO2 profile, yields, and potential health/toxicity risks. It is therefore unclear if regulators will account chemically recycled content for recycling targets, recycled content targets and tax breaks. This will heavily impact the success and scale of chemical conversion plants.

Sources of capital for Chemical Conversion

Primary sources

Secondary sources

Chemical recycling technology providers operating at pilot and early stage technology providers who produce predominantly plastic polymers are on average an attractive opportunity for earlier stage investors or strategic companies such as large petrochemical companies who can finance their investment through internal revenue without requiring external financing. Investors and strategic partners are leveraging a mix of financial instruments and strategies to capture this market opportunity. Among private capital providers involved in this sector are:

-

Petrochemical and plastic industry actors such as Dow, Indorama, TOTAL and others

-

Brands and their venture funds, across categories including: consumer goods, airlines, cosmetics, fashion and apparel

-

Impact investors and VC funds including Breakthrough Energy Venture, Closed Loop Partners, Cycle Capital Management, Kleiner Perkins

Some development capital providers and philanthropies also provide capital to the sector. Among those are national and local government agencies, quasi-governmental capital providers, research institutions, and support organizations, including in North America NASA, NREL (the National Renewable Energy Lab), REMADE Institute, state economic development agencies. Notable examples outside of North America can be found in the EU and UK, e.g., Ellen MacArthur Foundation.

Public funding is critical to bridge investment gap for earlier-stage chemical conversion technologies as they go through proof-of-concept demonstration stages. Public funding can also support later-stage technologies with financing products that de-risk projects; for example, loan guarantees, capital exemptions and incentives that encourage investment into key areas of system change.

De-risking instruments

The most suitable de-risking instruments for chemical conversion are grants for early-stage initiatives, and guarantees or offtake agreements for operational projects.

Enabling System Conditions

Other enabling conditions

-

Develop a solid business case: While advances in the technologies have been made, the business case for chemical recycling technologies is still in its infancy. To scale up, further innovation, demonstration, and policy frameworks are needed.

-

Risk-sharing approach: The chemical industry continues to invest in research but require support from public and concessionary funds to share the risk in crossing the innovation's "valley of death" and make sure chemical recycling technologies can be successfully commercialized

-

Policies that support circular downstream material management such as recycled content mandates for products and packaging; and incorporating chemical recycling into extended producer responsibility legislation

-

Provide financial incentives like tax credits that encourage upstream collaboration, investment into feedstock pre-processing, and investments in best performing chemical conversion operations

-

Capacity building: The chemical transition has significant implications for employment and the labour market. As the industry evolves, countries need to meet the rising demand for skilled workers capable of developing, implementing, and maintaining new technologies and processes.

-

Collection and logistics: CR plants need large volumes of consistent, economically feasible feedstock to be viable. To process the difficult-to-recycle materials, those items must be segregated and sent to the chemical recycler at relatively low cost and high quality, in turn necessitating widespread logistical planning and growth in local and regional collection networks.

-

New feedstock collection and cleaning: Successful collection and aggregation of quality feedstocks will be critical to providing the scale needed to run CR facilities. In addition, CR will need to process both postindustrial and postconsumer materials to fully realize a circular economy for packaging. Additional investment will be needed to ensure the full suite of materials to feed CR is collected at a level to support a capital investment (i.e., post-consumer film collection needs more scale).

Financing challenges

-

Investment system dependence: Investment in chemical recycling depends on vastly improving upstream waste collection through consumer behaviour campaigns, and infrastructure development. The cost of managing all waste streams is significant and the chemicals industry may not be able to finance this transition alone.

-

Feedstock constraints: Similar to mechanical recycling investment projects, as chemical recycling technologies are deployed, there may be additional feedstock constraints given the relatively low recovery rate of plastic waste. While the chemical recycling technologies can accept lower quality feedstock compared to mechanical recycling technologies, the uptake in demand may lead to increasing costs of supply sector wide, applying further pressure on investment returns.

-

R&D needed to scale-up: Chemical recycling currently exists predominantly at an early stage level and requires further innovation efforts before being rolled out for subsequent commercialisation. To scale up, further research and development of the business case for chemical recycling is needed

-

High upfront investment: Investment in advanced chemical recycling technologies requires high upfront investment

-

GPAP Report 2022Read More

Aarhus City Deposit System

Aarhus Municipality and TOMRA enter collaboration to establish a deposit system for takeaway packaging

-

GPAP Report 2022Read More

GPAP Report 2022Read MoreAlgramo — B2C packaging reduce and reuse model

Chilean start-up Algramo expanding its packaging reuse model abroad

-

IFC Case StudyRead More

IFC Case StudyRead MoreBelgrade Waste-to-Energy Project

Public-private partnership combining de-risking and private sector innovation to support waste management in Serbia

-

StartupRead More

B'ZEOS Seaweed Packaging

Using science and seaweed to tackle the plastic pollution problem

-

GPAP Report 2022Read More

GPAP Report 2022Read MoreCoca Cola FEMSA Green Bond

Bottling company catalyzing growth of rPET infrastructure in Mexico

-

Katpult OceanRead More

Fortuna Cools

A Philippines-based agritech startup making sustainable coolers out of coconut fibre, supported by seed funding to ramp up production

-

GPAP Report 2022Read More

GPAP Report 2022Read MoreIndorama Ventures Blue Loan

The world's first blue loan to expand recycling capacity across emerging markets

-

KfWRead More

Landfill in Albania

Funding from KfW to finance landfills in Albania

-

GPAP Report 2022Read More

Natura Sustainability Linked Bond

Issuing the first Latin American Sustainability-Linked Bond (SLB) to target plastic reduction

-

PabocoRead More

Paboco Joint Venture

Paboco to produce fully recyclable paper bottles in 2024

-

Plastic EnergyRead More

Plastic Energy

Chemical recycling company fuels its growth through institutional fundraising

-

STOPRead More

Project STOP Indonesia

Project STOP collaborates with city governments in Indonesia to establish waste collection and sortation systems, supported by grant funding from corporate partners and donor agencies

-

GPAP Report 2022Read More

Recykal

A digital marketplace for plastic waste transactions in India

-

ODARead More

Solid Waste Management Project in Peru

ODA loan agreement with Peru to develop landfills in Peru

-

GPAP Report 2022Read More

Tridi Oasis

An innovative recycling startup in Indonesia proves resilient with the help of early-stage blended finance

-

JICARead More

Waste-to-Energy and Waste Treatment Project in Vietnam

Chemical recycling company fuels its growth through institutional fundraising

-

Government FundingRead More

Bueno Aires waste collection systems

Providing waste collection services to the municipality of Buenos Aires, Argentina

-

Private EquityRead More

IFCO acquisition by PE fund Triton

Reusable packaging solutions provider acquired by Triton and a wholly-owned subsidiary of the Abu Dhabi Investment Authority (ADIA), for US$ 2.51 billion

-

CircolutionRead More

Circolution receives seed funding from Amcor

Amcor, a global packaging solutions leader, has invested $250,000 into smart reusable food packaging start-up Circolution

-

NotplaRead More

Notpla raises £10M to develop seaweed-based packaging

London-based Notpla, a sustainable packaging startup, announced that it has raised £10M in its Series A round of funding

-

USAID ReportRead More

Indonesia's Waste4Change raises $5m in series A funding

Indonesia-based waste management platform Waste4Change announced Friday that it has secured a $5 million series A funding round

-

COLIBARead More

Coliba Africa

Coliba Africa secured $850,000 from USAID and support from the Alliance to End Plastic Waste to train 6,000 waste collectors and establish recycling facilities with a 14,000-ton capacity.

Aarhus City Deposit System

Aarhus and TOMRA have joined forces to create deposit system for takeaway packaging in the city center of Aarhus. The municipality and the company have signed a collaboration agreement for a three-year trial, which initially focuses on take away cups with a deposit. In next stages the plan is to expand the system to also cover all types of takeaway packaging ensuring a convenient and circular system. The pilot reuse system will enable the shift from single use packaging to reusable packaging, by providing an infrastructure that entire cities can use.

TOMRA and Aarhus City enter collaboration to create innovative reuse system

Algramo — B2C packaging reduce and reuse model

Founded in 2012, Algramo initially pursued a model facilitating reuse of household containers that used tricycles fitted with dispensers to sell non-perishables like rice and laundry detergent to low-income families in Chile. It then established vending machine dispensers — with reusable containers that enable consumers to buy exactly the amount they want — in retail outlets in poorer areas of Santiago. Having raised over $11 million in aggregate over two funding rounds in 2019 and 2021 from US, Mexican, and European investment funds, Algramo is now expanding its reuse model, using radio-frequency identification (RFID) tagged containers in the US, UK, Mexico, and Indonesia.

GPAP (2022), Unlocking the Plastics Circular Economy: Case Studies on Investment

Belgrade Waste-to-Energy Project

In 2015, the City of Belgrade started working with IFC to design a public-private partnership to overhaul the city's waste management system focused on the Vinča landfill. The project, which received €260 million in financing and guarantees from IFC, MIGA, and others, including a €20 million blended concessional loan from the Canada-IFC Blended Climate Finance Program, was managed by a consortium including Veolia, ITOCHU, and Marguerite Fund II. The integrated Vinča project includes a new energy recovery facility, a cogeneration facility, and a construction and demolition waste recycling plant, alongside a new sanitary landfill meeting EU and Serbian standards. Operational since February 2023, the waste-to-energy facility processes up to 340,000 tons of waste annually, generating up to 30 MW of electricity and 56 MW of thermal energy, enough for 30,000 households' electricity and 60,000 households' heating. The recycling plant handles 200,000 tons of construction waste per year. This initiative is expected to cut Belgrade's greenhouse emissions by 210,000 tons of CO2 equivalent annually and has created 120 permanent and 600 construction jobs. This is also notably the first large-scale private sector waste management project in emerging markets and the first in Serbia to receive Gold Standard Carbon Credit Accreditation.

Belgrade’s Waste-to-Energy Project Sparks Environmental Renaissance

B'ZEOS Seaweed Packaging

The Norwegian start-up B'ZEOS develops novel bio-based packaging solutions with the aim to replace the need for single-use plastic. B'ZEOS has received grants from Innovation Norway and the EU via an R&D funding scheme for the blue bioeconomy. The company has collaborated with Nestlé in the development of food packaging prototypes, from edible straw formulation to pilot scale manufacturing of flexible films packaging.

Coca Cola FEMSA Green Bond

As the Government of Mexico considered legislation to improve the country's management of solid waste, Coca-Cola FEMSA, in collaboration with bottling and plastics industry peers including PepsiCo bottler GEPP, supported the establishment of ECOCE (Ecología y Compromiso Empresarial, or Businesses Committed to Environmentalism), a non-profit dedicated to improving recycling rates in Mexico. Using price incentives to encourage greater PET bottle collection, the consequent increase in recycling rates and reliability of local rPET (recycled PET) feedstocks helped mobilize capital to develop local recycling infrastructure. Early on, this capital was sourced from the International Finance Corporation (IFC), a private sector-focused global development institution, and other commercial return seeking institutions. Subsequent capital came from recycled plastic stakeholders in Mexico — most recently through investment by Coca-Cola FEMSA funded by the tightly priced issuance of a green bond, for which Morgan Stanley served as joint bookrunner. The aggregated capital helped create domestic PET processing infrastructure, broadened he number of market participants engaged in tackling plastic waste, and increased the quantity of recycled material in plastic packaging in Mexico.

GPAP (2022), Unlocking the Plastics Circular Economy: Case Studies on Investment

Fortuna Cools

Founded in 2018, Fortuna Cools, a Philippine startup, works alongside small-scale agricultural communities and offers coolers and insulated packaging made from up-cycled, biodegradable coconut fibers to help fishermen preserve their catch without relying on fragile Styrofoam boxes. The coolers offer communities a more robust and lower cost cold storage solution. In 2021 the UN Development Program awarded Fortuna's Coconut Cooler the Ocean Innovation Prize for accelerating the shift from plastic foam to biodegradable alternatives. Fortuna Cools secured a seed investment round led by ADB Ventures (the impact investment arm of Asian Development Bank) and Katapult Ocean Fund.

Indorama Ventures Blue Loan

With strong demand from its global customer base and a drive to advance its own environmental, social, and corporate governance (ESG) credentials, Indorama Ventures Ltd. (IVL), the world's largest producer of PET bottles, committed to double its recycling capacity by investing $1.5 billion in processing facilities across five strategic emerging markets. To achieve this, IVL secured a blue loan financing package valued at $300 million from three development finance institutions (DFIs): the International Finance Corporation (IFC), Asian Development Bank (ADB), and Deutsche Investitions- und Entwicklungsgesellschaft (DEG). The new financing generated further investment in recycling infrastructure by IVL. This innovative financial instrument is the world's first independently verified, non-sovereign blue loan, and has fostered the development and acceptance of issuance guidelines for the nascent blue bond market.

GPAP (2022), Unlocking the Plastics Circular Economy: Case Studies on Investment

Landfill in Albania

KfW, a German development bank, lead the financing of a EUR27.5m funding package to Albania to finance a programme for sustainable solid waste management in the Vlora district. The programme focused on the construction of a new regional sanitary landfill for solid waste, sorting and composting facilities, equipment, and closure of existing dumpsites in the Vlora area.

Financing Experiences and Opportunities for SWM in Albania

Natura Sustainability Linked Bond

In 2021, Natura Cosméticos S.A. (Natura), a wholly owned subsidiary of Natura &Co, issued a sustainability linked bond (SLB). One of the objectives of the bond was increased use of recycled plastic in the company's packaging. A majority of Latin American SLBs to date have also included GHG reduction targets, alongside a recycled plastics mandate (as Natura did) that positions the circular economy as an instrument to attain climate objectives. Natura's bond garnered strong investor interest, with Morgan Stanley acting as joint bookrunner. Building incentives into Latin American SLBs for issuers to meet their ESG targets could underpin increased issuance in other emerging markets, where accountability and transparency are often lacking.

GPAP (2022), Unlocking the Plastics Circular Economy: Case Studies on Investment

Paboco Joint Venture

Paboco (The Paper Bottle Company) was founded in 2019 as a joint venture between ALPLA and pulp and paper manufacturer Billerud. Together with the Pioneer brands Carlsberg, L'Oréal, Coca-Cola Europe, and Absolut as well as its technology partners, Paboco is working intensely on realizing its long-term objective: the development and scaling of a fully bio-based, recyclable, fiber-based bottle made of renewable materials. This bottle could replace both single-use glass bottles and plastic bottles. After the successful test phase, series production of the next generation of recyclable paper bottles is scheduled to start at the end of 2024.

Denmark's Paboco to produce fully recyclable paper bottles at new facility in 2024

Plastic Energy

Plastic Energy is a chemical recycling solution providers which converts end-of-life plastic waste into feedstock for making virgin-quality recycled plastics. Plastic Energy has two chemical recycling plants in operation in Spain. Plastic Energy has agreements with chemical and oil and gas companies including SABIC, TotalEnergies and ExxonMobil to expand its recycling capabilities. Plastic Energy project portfolio includes plans to build large scale plant in Malaysia, Indonesia, as well as in Europe. In 2022, Plastic Energy raised EUR145m from financial investors and corporate funding to accelerate its growth and expand its portfolio of recycling plants.

Plastic Energy Completes €145 Million Fundraise

Project STOP Indonesia

Launched in 2017 by Borealis and Systemiq, Project STOP (STop Ocean Plastics) works hand in hand with city governments to create effective circular waste management systems in high need areas of Southeast Asia. The initiative supports cities with technical expertise to achieve zero leakage of waste, increase recycling, build economically sustainable programs, creating new jobs and reducing the harmful impact of mismanaged waste on public health, tourism, and fisheries. While the first city partnership was established in 2017 in the municipality of Muncar, East Java in February 2022. Project STOP Muncar was handed over to the local government and communit y. Now the programme expands to the Banyuwangi regency combines a regency level waste system model with a material aggregator into a circular waste and recycling solution that can transform waste economics. Project STOP also operates two additional city part ner ships, in Pasuruan Regency, East Java where the programme is now fully owned by local authorities and the community in February 2023, and Jembrana Regency, in Bali. Project STOP's corporate partners include the Nestlé, Borouge, the Alliance to End Plastic Waste, Siegwerk, Shwarz, and HP, with support from Trusts & Foundations, P4G and Accenture, including Academia, Pisces. Project STOP's success is in large part thanks to these collaborations as well as its close partnership with Norwegian government, USAID, local and national government offices in Indonesia, including the National Ministry for Environment and Forestry (KLHK) and the Coordinating Ministry for Maritime and Investment Affairs (CMMAI) and the Regency governments in the regions it works.

Recykal

The Indian government's Swaach Bharat (Clean India) mission helped to catalyze Recykal's solution to bring transparency and traceability to India's plastic waste supply chain via a digital platform. The waste management start-up secured $26 million in funding from domestic and international investors, including Morgan Stanley, in just three years. By encouraging the migration of plastic waste transactions to a digital marketplace, Recykal's model also promises greater standardization and reliability of associated data, bolstering the investment case for allocating capital to the sector.

GPAP (2022), Unlocking the Plastics Circular Economy: Case Studies on Investment

Solid Waste Management Project in Peru

In 2012, the Japan International Cooperation Agency (JICA) signed ODA loan agreements with the government of Peru to provide loans of up to 8.77 billion yen for assistance for the Energy Renovation Infrastructure Assistance Program and up to 4.396 billion yen for assistance for the Solid Waste Management Project. The objective of the Solid Waste Management Project is to establish efficient and sustainable solid waste management system in the 23 prioritized cities by constructing solid waste infrastructures as well as developing and/or rehabilitating solid waste collection and recycling/ recovering systems thereby contributing to improve environmental quality and living standard of the people in the target regions in Peru. It also aims to contribute to the alleviation of climate change. Through this project, JICA will assist the first trial of the central government of Peru to undertake and supervise the nationwide program to construct an integral waste management system in many local cities, which will be a crucial step for the development of waste management system in Peru. Coordinating with the IDB, JICA will advance the project while providing appropriate assistance to MINAM, which will supervise the project. The possibility of technical cooperation, dispatching volunteers and other such steps are also being considered for enhancing the capacity of the local municipalities to operate, maintain and manage the facilities constructed and settled by this project, as is assistance for environmental-education to the residents. The funding for this project will be allocated to civil works for the construction of sanitary landfills, procurement of materials and equipment (including heavy machinery for sanitary landfills and vehicles for collection and transportation of waste) and consulting services.

Signing of Japanese ODA Loan Agreements with the Republic of Peru

Tridi Oasis

Tridi Oasis was founded in 2016 by two women entrepreneurs as a processor of post-consumer PET bottles into flakes. Beyond the founders' start-up funds, seed capital was provided by a local venture firm and a Java-based non-profit. By 2019, Tridi Oasis had expanded its capacity and needed additional capital. Circulate Capital's Ocean Fund, a blended finance vehicle offering early-stage venture debt and equity, extended its first loan to Tridi Oasis in early 2020. The loan benefited from a 50% credit guarantee provided by the U.S. International Development Finance Corporation (DFC), which partially de-risked the fund's investment while allowing the founders to maintain their existing equity. A second loan in early 2021 combined with technical assistance allowed Tridi to maintain operations through the Covid-19 pandemic and even increase productivity. Ultimately, in 2022 the company was able to attract an experienced strategic partner and pursue further expansion.

GPAP (2022), Unlocking the Plastics Circular Economy: Case Studies on Investment

Waste-to-Energy and Waste Treatment Project in Vietnam

In 2022, the Japan International Cooperation Agency (JICA) signed a US$ 7 million loan agreement with Binh Duong Water Environment Joint Stock Company ("BIWASE") in Vietnam. This loan is co-financed by the Asian Development Bank (ADB). The US$ 6 million from ADB will be financed through the Leading Asia's Private Infrastructure Fund (LEAP), which is funded by JICA and administered by ADB. This project aims to contribute to the improvement of the urban environment and the circular economy in the region by financing the construction of a composting plant with a capacity of 840 tons per day and a waste-to-energy incineration facility to process 200 tons per day. BIWASE, the borrower of the project, established in 1975 and privatized in 2016, is a water-supply and waste-treatment company, and is the sole waste-treatment company that provides general waste treatment in Binh Duong Province.

Bueno Aires waste collection systems

In 2014, the municipality of Buenos Aires, Argentina, contracted the management of its waste management services to Proactiva Medio Ambiente, a Veolia subsidiary. The ten-year contract represents cumulative revenues of €500 million. Proactiva is responsible for collecting solid household waste and urban cleaning services in central Buenos Aires. To improve both service performance and health conditions, Proactiva implemented a waste containerization system throughout the service area.

IFCO acquisition by PE fund Triton

In 2019, IFCO SYSTEMS, a leading global provider of reusable packaging solutions for fresh foods, was acquired by to Triton, a private equity fund, and the Abu Dhabi Investment Authority (ADIA), for an enterprise value of US$ 2.51 billion. At the time IFCO generated revenues of more than US$1.1 billion.

IFCO announces acquisition by Triton for US$ 2.5 billion - IFCO Systems

Circolution receives seed funding from Amcor

In 2023, Amcor, a global leader in developing and producing packaging solutions, has announced a $250,000 investment into smart reusable food packaging start-up Circolution, the third winner of Amcor's Lift-Off initiative. Launched in April 2022, Amcor Lift-Off targets breakthrough, state-of-the-art technologies that will further advance Amcor's goal to make the future of packaging more sustainable. Circolution is the third company to secure funding through Amcor's Lift-Off initiative, which offers packaging start-ups up to $250,000 investment (convertible loan) to help scale their innovations, as well as access to Amcor's research and development resources.

Notpla raises £10M to develop seaweed-based packaging

In 2021, Notpla, a London-based sustainable packaging startup, has recently secured £10 million in a Series A funding round. This round was led by Bangkok-based Horizons Ventures, with additional contributions from Astanor Ventures, Lupa Systems, and Torch Capital. Established in 2014 by Rodrigo Garcia Gonzalez and Pierre-Yves Paslier, Notpla aims to combat plastic pollution by creating packaging solutions from seaweed and plants. Their innovative approach aligns with the EU Single-Use Plastic Directive, offering products that biodegrade within 4-6 weeks without the need for industrial composting. Notably, Notpla has developed "Ooho", an edible and fully biodegradable packaging made of seaweed, which has replaced over 500,000 single-use plastics at major events. They have also introduced a seaweed-coated cardboard for food packaging, in collaboration with Just Eat Takeaway.com. The recent funding will boost manufacturing and support the development of new products like transparent flexible films and seaweed paper. Notpla's unique, sustainable solutions are gaining traction, and they plan to expand into the cosmetics and fashion industries, underscoring their commitment to a future free of single-use plastics.

Indonesia's Waste4Change raises $5m in series A funding

Waste4Change, an Indonesia-based waste management startup, recently secured a $5 million Series A funding, co-led by AC Ventures and PT Barito Mitra Investama, with notable contributions from Basra Corporation, Paloma Capital, and others. Since its inception in November 2014, the company has committed to addressing Indonesia's waste management challenges, focusing on reducing landfill waste and enhancing recycling efforts. This fresh infusion of capital is earmarked for expanding Waste4Change's waste management capacity to 100 tons per day within the next 18 months, aiming for a significant increase to 2,000 tons per day over the next five years. Integral to this expansion is the integration of digital technologies for enhanced waste management processes and the automation of material recovery facilities. Furthermore, the company plans to fortify partnerships within the country's informal waste sector. Waste4Change operates across 21 Indonesian cities, managing more than 8,000 tons of waste annually and demonstrating a robust growth trajectory, with a Compound Annual Growth Rate (CAGR) of 55.1% since 2017. Under the leadership of founder and CEO Mohamad Bijaksana Junerosano, Waste4Change is not only scaling its operations but also aligning with the Indonesian government's environmental objectives, reinforcing its commitment to sustainable waste management solutions.

Indonesia's Waste4Change grabs $5M Series A co-led by AC Ventures - TNGlobal (technode.global)

Coliba Africa

Coliba Africa is a Cote-d'Ivoire-based recycling and waste management start-up. The company received financing for a 28-month project integrating informal waste collectors into Coliba's business model and training them to build better businesses. Coliba received a grant from USAID West Africa Trade & Investment Hub totalling $850,000, to implement its training and capacity building project. The Trade Hub grant with a loan from the Alliance to End Plastic Waste, and other stakeholders will fund a project to train 6,000 informal waste collectors, set up modern waste collection and recycling facilities with a capacity of 14,000 tons per year. The Alliance also provided the technical expertise needed to help the project develop a holistic waste management ecosystem.

World Bank's Plastic Policy Simulator (PPS)

Plastic Policy Simulator (2022)

GPAP National Analysis and Modeling (NAM) Tool

GPAP's National Analysis and Modeling (NAM) Tool allows countries to establish a science-based roadmap to accelerate their transition to a circular, low carbon emissions plastics system. It has been implemented in 12 countries to date.

Global Plastic Action Partnership NAM Tool

The Circulate Initiative’s Plastics Circularity Investment Tracker

The Circulate Initiative's Plastics Circularity Investment Tracker provides insights into private investments in plastics circularity globally.

Plastics Circularity Investment Tracker, The Circulate Initiative

Intergovernmental Negotiating Committee on Plastic Pollution (INC)

Intergovernmental Negotiating Committee on Plastic Pollution (INC)

UNEP Zero draft text of the international legally binding instrument on plastic pollution

Unlocking the Plastics Circular Economy: Case Studies on Investment

Unlocking the Plastics Circular Economy: Case Studies on Investment, GPAP (2022)

Redirecting financial flows to end plastic pollution

Redirecting financial flows to end plastic pollution, UNEP-FI (2023)

Breaking the Plastic Wave

Breaking the Plastic Wave, Systemiq

Mobilizing Blended Finance for Circular Waste Collection and Sortation

Mobilizing Blended Finance for Circular Waste Collection and Sortation, Systemiq (2023)